When you think of a credit score, you might not think about car insurance. But, surprise! Your credit score can affect how much you pay for car insurance. Let’s dig into why this happens and what you can do about it.

What is a Credit Score?

A credit score is a number that shows your money habits. It tells if you pay your bills on time. Banks look at it when you want to borrow money. Insurance companies look at it too.

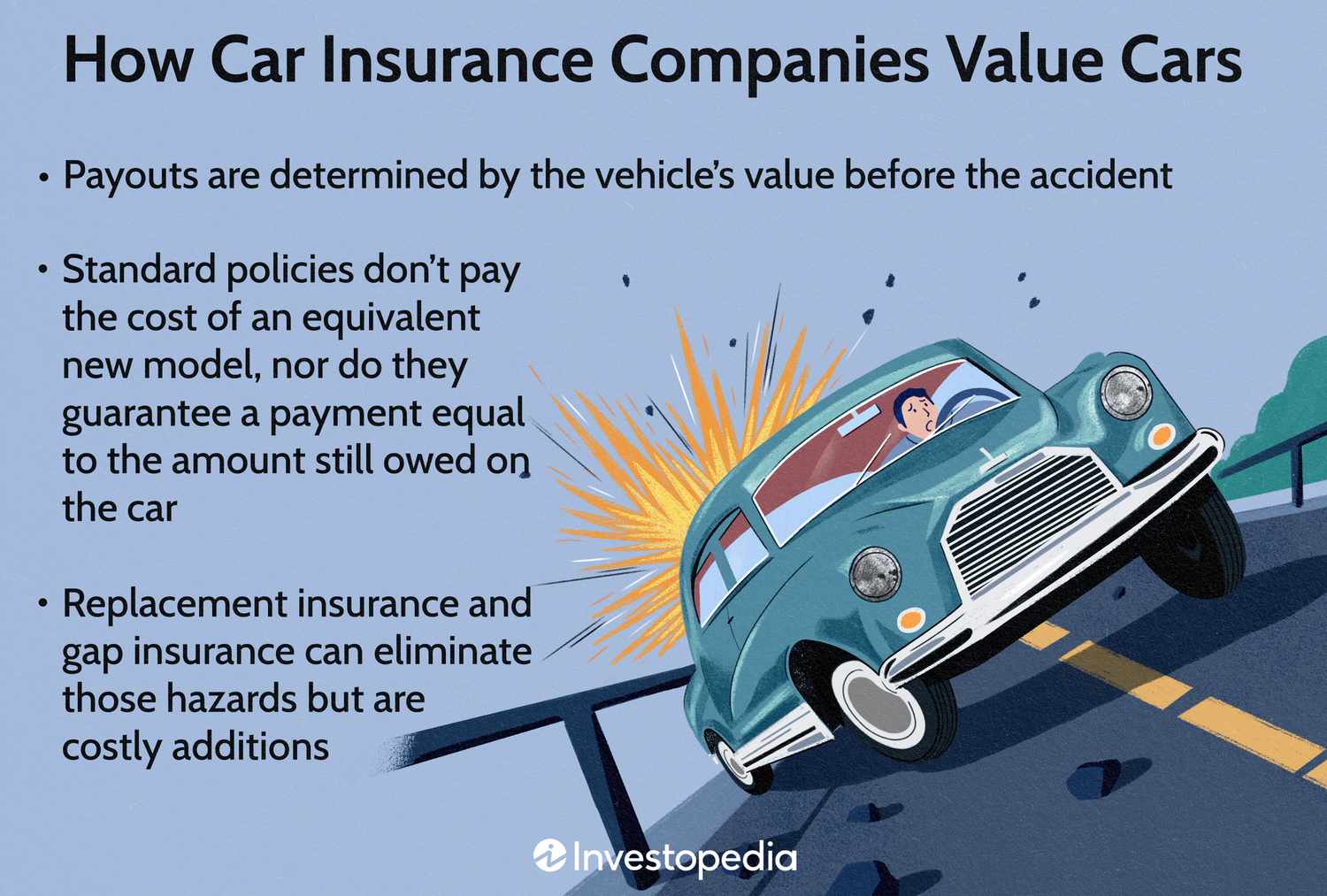

How Do Insurance Companies Use Credit Scores?

Insurance companies use your credit score to figure out what to charge you. But, not all states let them do this. If they do, a good score might mean you pay less for car insurance.

Why Does a Credit Score Affect Car Insurance?

Insurance companies think that if you have a good credit score, you are less likely to get into accidents or file claims. That’s why they may charge you less if your score is good.

:max_bytes(150000):strip_icc()/7-factors-affect-your-life-insurance-quote.asp_V2-ba373e2794d94d97abd3e15cc60bed4e.png)

Credit: www.investopedia.com

Is It Fair to Use Credit Scores?

Some people think it’s not fair to use credit scores for car insurance. They argue it can hurt people who have low income or have had money troubles.

Credit: www.frontiersin.org

States That Don’t Allow Credit Scores

Some states have said “No” to using credit scores for car insurance. These states are California, Hawaii, and Massachusetts.

What Can You Do to Help Your Credit Score?

Here are some tips to help your credit score go up:

- Pay bills on time: Always try to pay your bills when they’re due.

- Keep credit card balances low: Don’t spend too much on your credit cards.

- Don’t open too many new accounts: Only get new credit cards when you really need them.

How to Find Car Insurance If You Have a Low Credit Score

Don’t worry if your credit score isn’t perfect. You can still find good car insurance. Shop around and compare prices to find the best deal for you. Some companies care less about credit scores.

Frequently Asked Questions On Does Credit Score Affect Car Insurance? Unveiling The Truth!

How Does Credit Score Influence Car Insurance Rates?

Your credit score can significantly affect your car insurance premiums. Insurers often use credit-based insurance scores to gauge risk and set rates accordingly.

Can Improving Credit Lower Insurance Costs?

Yes, boosting your credit score could lead to lower car insurance premiums as insurers view you as a lower risk.

What Is A Credit-based Insurance Score?

A credit-based insurance score reflects the likelihood of filing an insurance claim, utilizing certain elements of your credit history.

Do All Insurers Consider Credit Scores?

Most, but not all, car insurance companies use credit scores. Some states prohibit the use of credit in setting rates.

Conclusion

Your credit score can be important for car insurance. It helps companies decide how much you pay. Keep your credit score healthy by paying bills on time and being smart with money. Always shop around for the best car insurance prices, even if your credit score isn’t high.