When you turn 16, many exciting things happen. You can get your driver’s license. For many teens, it is the start of a new adventure. But when you start driving, you need something called car insurance.

What is car insurance? It helps pay for car accidents. It can cover car damage or injuries to people. All drivers must have it.

The Cost of Car Insurance for 16-Year-Olds

For a 16-year-old, car insurance can be costly. Why? Because new drivers often make mistakes. And mistakes on the road can lead to accidents.

Car insurance companies look at this as a risk. Because of that risk, they usually make 16-year-olds pay more.

| Type of Coverage | Average Annual Cost |

|---|---|

| Liability Only | $2000 – $2500 |

| Full Coverage | $3500 – $4000 |

Note: These numbers can change. It depends on where you live and what car you drive.

Why is Car Insurance Expensive for 16-Year-Olds?

- Less driving experience

- Higher chances of accidents

- More likely to get speeding tickets

- Often more impulsive

In general, car insurance gets cheaper as you get older. By age 25, you’ll likely see lower prices.

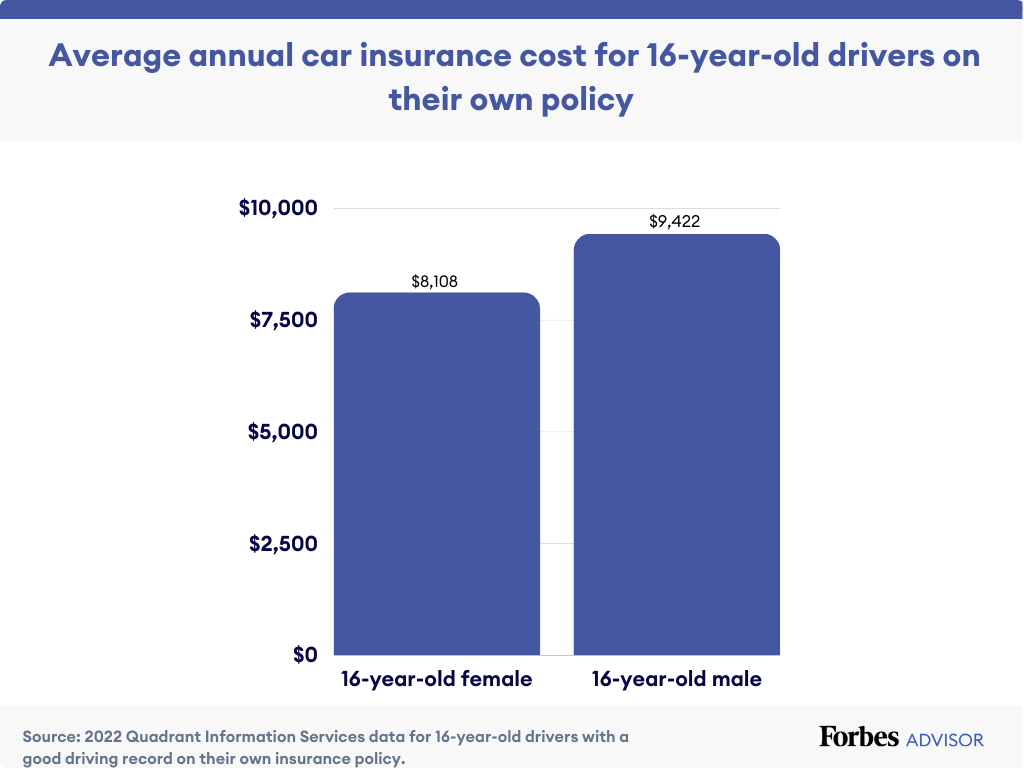

Credit: www.forbes.com

How to Lower the Cost of Car Insurance for Teens

Even though insurance is pricey, there are ways to save money.

Good Student Discounts

If you do well in school, you could save on car insurance. Many companies offer ‘good student’ discounts. You usually need a ‘B’ average or better.

Defensive Driving Courses

Taking a defensive driving class can also lower your rates. It shows you’re working to be a careful driver.

Choose The Right Car

The car you drive affects your insurance cost. Choose a safe, reliable car. It should not be too expensive or too fast.

Added To Parents’ Policy

It’s often cheaper to get added to your parents’ policy than to get your own. Ask them if this is an option.

Shop Around For Rates

Get quotes from different insurance companies. Compare their prices and coverage.

Credit: www.valuepenguin.com

Understanding Car Insurance Coverage

There are several types of coverage:

- Liability Coverage: Pays for damage you cause to others.

- Collision Coverage: Pays for damage to your car from a crash.

- Comprehensive Coverage: Covers other types of damage (like theft).

Each type protects you in different ways. You should have them all for full protection.

Frequently Asked Questions

Can A 16-year-old Get Their Own Car Insurance?

Yes, but it is usually more expensive than joining a parent’s policy.

How Can Students Without A ‘b’ Average Save On Insurance?

They can still save by driving safely and shopping around for good rates.

Are Certain Cars Cheaper To Insure For Teens?

Yes, typically cars that are not sports cars are cheaper to insure.

Frequently Asked Questions For How Much Is Car Insurance For A 16-year-old: Save Big!

What Affects 16-year-old Car Insurance Costs?

Several factors can influence the cost of car insurance for a 16-year-old, such as their driving record, the type of car, their location, and the coverage options chosen.

Average Insurance Price For 16-year-old?

On average, car insurance for a 16-year-old can range from $1,500 to over $5,000 annually, depending on various factors including the insurer.

Is Car Insurance Higher For New Drivers?

Yes, new drivers, especially teens, typically face higher insurance rates due to their lack of driving experience and higher accident risk.

Ways To Lower Car Insurance For Teens?

Teens can lower their car insurance costs by maintaining a good driving record, enrolling in defensive driving courses, and qualifying for good student discounts.

Conclusion

Car insurance for a 16-year-old can be quite high. But with the right strategies, you can find affordable options. Be a good student, a careful driver, and choose the right car. Don’t forget to compare prices from different insurance companies.

Always remember, driving is a big responsibility. With a good attitude and the right coverage, you’ll be ready for the road!