If you have a 16-year-old, you might wonder about car insurance costs. Car insurance for young drivers can be higher than for adults. Let’s explore why and how much it may cost each month.

Why is Car Insurance Pricier for Young Drivers?

Insurance companies think about risks when they set prices. New drivers often have less experience. This means they are more likely to have accidents. This is why costs for young drivers are higher.

Credit: www.forbes.com

Factors Affecting Your Insurance Costs

- Type of Car: Faster cars can cost more to insure.

- Where You Live: Some places have higher insurance prices.

- Grades in School: Good grades might get you discounts on insurance.

- Driving Courses: Drivers who learn from special courses may get lower prices.

Credit: www.forbes.com

Average Monthly Costs

The cost of car insurance for a 16-year-old can vary a lot. It often depends on the above factors. But we can still talk about average costs.

| Type of Coverage | Average Monthly Cost |

|---|---|

| Minimum Coverage | $150 – $300 |

| Full Coverage | $350 – $500 |

Remember, these are average numbers. Your own costs may be different.

Ways to Decrease Insurance Costs

Saving money on car insurance is important. Here are some tips to help with that:

- Stay on your parents’ policy: It’s often cheaper than getting your own.

- Drive safely: Avoid tickets and crashes to keep costs down.

- Pick a sensible car: Choosing a safe, reliable car can save money.

- Good Student Discounts: Work hard in school for a possible discount.

- Defensive Driving Courses: Taking a driving course can help lower costs.

What to Do Next

It’s time to start looking for insurance if you have a 16-year-old driver. Here are the steps to follow:

- Research: Look up different companies and their prices.

- Compare Quotes: Get quotes from various companies to compare.

- Ask Questions: Talk to insurance agents to understand better.

- Make a Decision: Choose the best option for your needs and budget.

- Stay Informed: Keep an eye on your insurance and adjust when needed.

Frequently Asked Questions Of How Much Is Car Insurance For A 16-year-old Per Month: Find Savings!

What Factors Affect Teen Car Insurance Rates?

Various factors such as the teen’s driving record, type of vehicle, state of residence, and the specific insurance provider can significantly influence insurance rates for 16-year-olds.

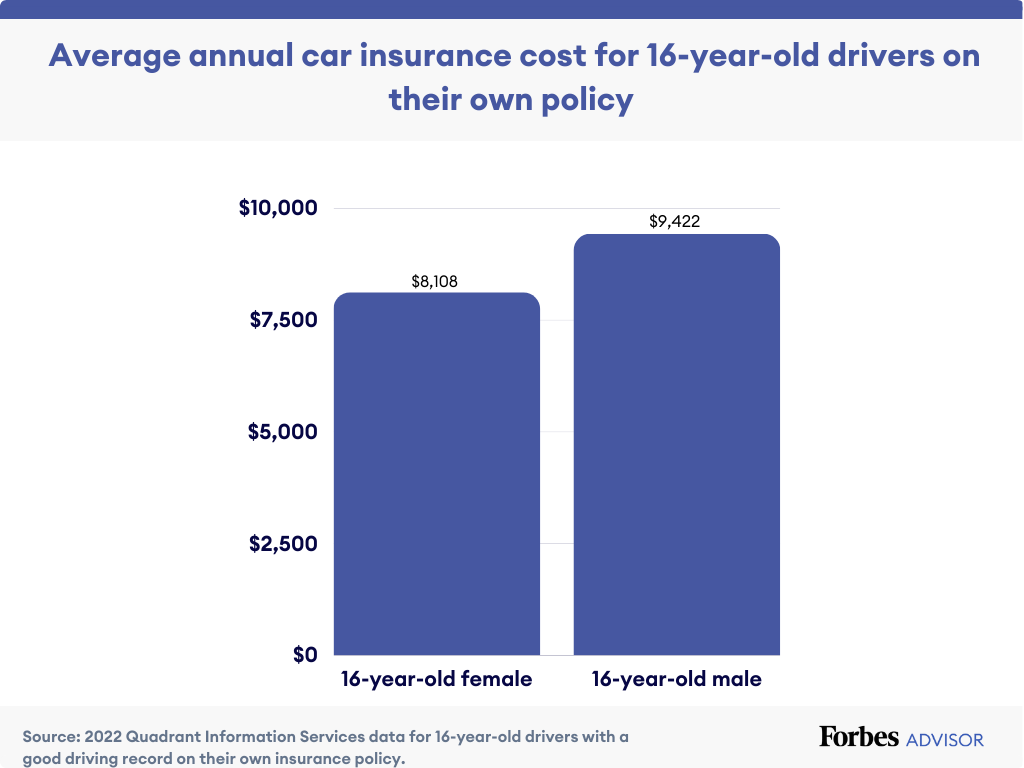

Is Car Insurance Higher For 16-year-old Males?

Yes, car insurance premiums are typically higher for 16-year-old males due to statistically higher risk and accident rates compared to females.

How Can I Reduce My 16-year-old’s Insurance Cost?

By choosing a vehicle with safety features, maintaining a good student discount, and enrolling in defensive driving courses, you can reduce insurance costs for your 16-year-old.

Do Good Grades Lower Car Insurance For Teens?

Indeed, many insurers offer good student discounts to teens with high academic achievements, effectively lowering their monthly car insurance costs.

Conclusion

Getting car insurance for a 16-year-old may seem pricey. But understanding why and how you can save money is important. By knowing the average costs and ways to reduce them, you’ll be ready for this new phase. Talk with insurance agents and continue to learn about your options. With a little research, you can find a policy that’s both protective and affordable.