Hello young drivers! Today we’re exploring car insurance costs for those aged 23.

Why Does Age Matter?

Car insurance companies see age as a big deal. Why? It tells them about your driving experience. Younger drivers often pay more because they have less experience. They are more likely to have accidents.

How Much is Car Insurance for a 23 Year Old?

The cost changes a lot. It can be between $1000 and $3000 per year. Some drivers may pay more, and some may pay less. It depends on many things like where you live, what car you drive, and how well you drive.

Factors That Affect Your Insurance Costs

- Where you live: City or countryside? Cities usually cost more.

- What car you have: Cars that cost more are often more to insure.

- Your driving record: Have you been in accidents? If you have, insurance might cost more.

- How often you drive: More driving can mean more risk and higher costs.

- Coverage type: Full coverage costs more than just the basics.

Average Costs by State

Each state is different. Below is a table with average costs for some states.

| State | Average Annual Cost |

|---|---|

| New York | $2,700 |

| California | $1,800 |

| Texas | $1,500 |

| Florida | $2,200 |

| Ohio | $900 |

:max_bytes(150000):strip_icc()/car-insurance-costs.aspFinal-67e96373fddc49dd960fbc316737ebcd.jpg)

Credit: www.investopedia.com

How to Save Money on Car Insurance?

You can save money on insurance, even at 23.

- Become a safer driver. Take courses to learn how to drive better.

- Choose a less expensive car. They are usually cheaper to insure.

- Drive less. Can you bike or walk instead sometimes?

- Ask about discounts. Good student? No accidents? There could be discounts for you.

- Shop around. Compare prices from different companies. Find the best deal for you!

Credit: www.valuepenguin.com

Frequently Asked Questions Of How Much Is Car Insurance For A 23 Year Old: Cut Costs Now!

What Factors Affect Car Insurance At Age 23?

Age is a significant factor in determining car insurance rates. At 23, insurers consider driving experience, credit history, vehicle type, and driving record to calculate premiums.

Is Car Insurance Higher For Young Drivers?

Yes, young drivers generally face higher insurance rates due to their increased risk profile and lack of driving experience compared to older drivers.

How Can 23-year-olds Reduce Insurance Costs?

To reduce insurance costs, 23-year-olds can maintain a clean driving record, choose a car that is cheaper to insure, increase deductibles, and look for discounts like good student or safe driver discounts.

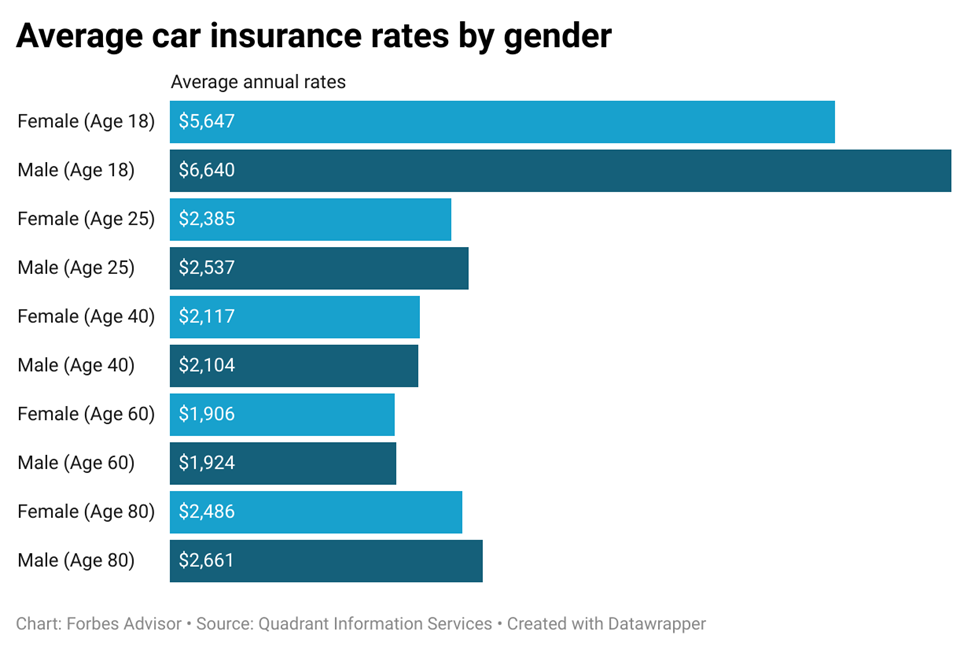

Does Gender Impact Car Insurance Rates At 23?

Gender can impact car insurance rates; statistically, young males often pay higher premiums than females due to a perceived higher risk of accidents.

Conclusion

So, how much is car insurance for a 23 year old? It varies.

Remember that many things will change your cost. Your state, your car, and how you drive matter.

But you can control some of it! Be smart. Choose wisely. Keep your eyes open for ways to save money. Drive safe out there!