Car insurance is a must for every driver in Massachusetts. But how much does it cost?

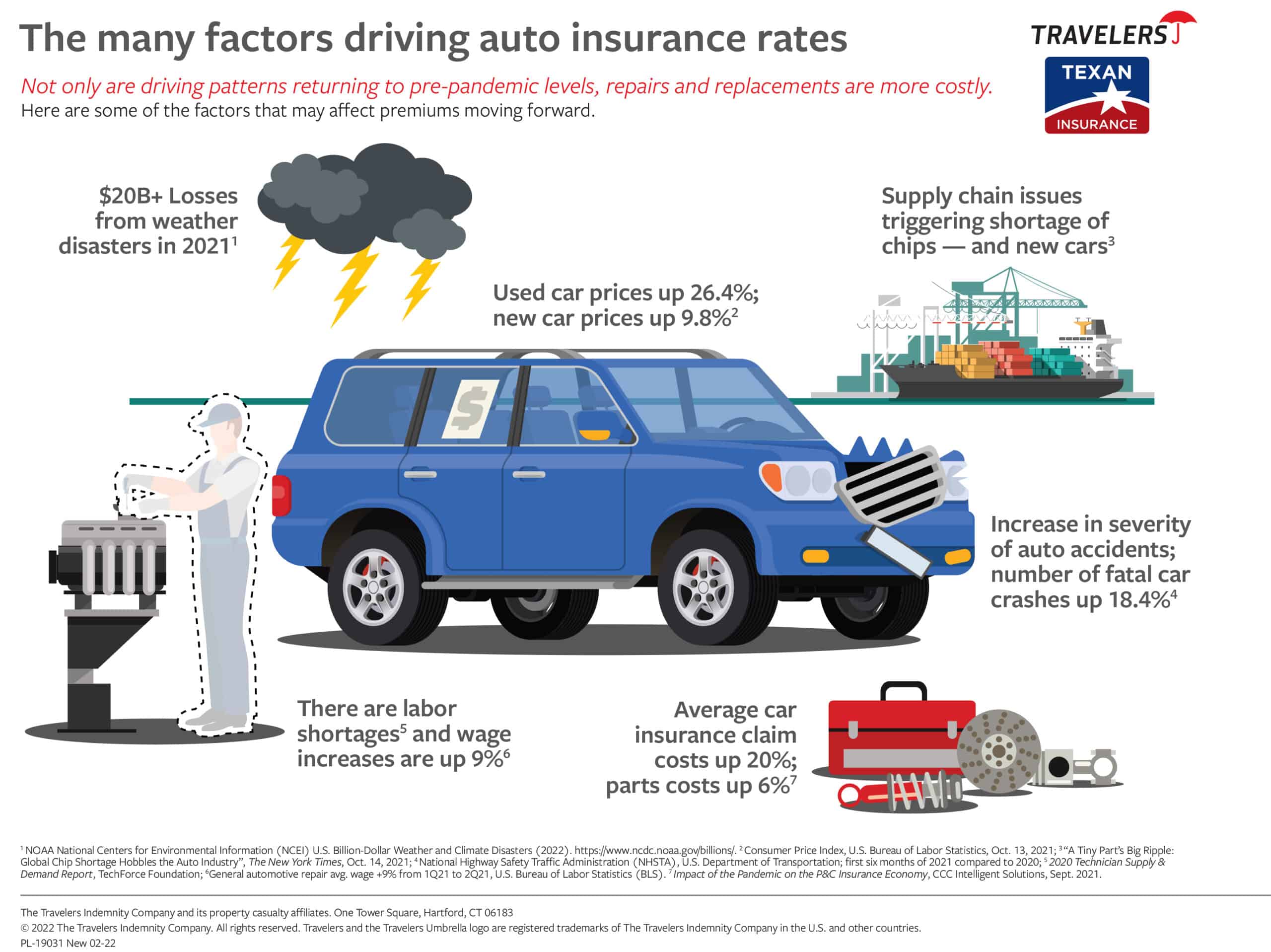

What Affects Your Car Insurance Cost?

Many factors make your insurance cost go up or down. Let’s check them out.

- Age: How old you are can affect your cost.

- Car Type: What kind of car you have matters too.

- Driving Record: If you drive well, you might pay less.

- Where You Live: In some places, it costs more.

- Credit Score: A good credit score might help.

The Average Cost of Car Insurance in MA

In Massachusetts, you might pay different amounts for car insurance.

| Type of Driver | Average Annual Cost |

|---|---|

| Good Drivers | $1,200 |

| Young Drivers (Under 25) | $2,400 |

| Senior Drivers (65+) | $1,100 |

| Drivers with an Accident | $1,800 |

These numbers are just averages. Your cost might be different.

Ways to Save Money on Car Insurance

You can do things to make your insurance cost less. Here are a few tips:

- Shop around and compare prices from different companies.

- Ask if you can get discounts for being a good student or driver.

- Put more than one car on the same policy, if you have more cars.

- Raise your deductible—that’s the money you pay before insurance helps.

- Take a driving safety class to show you’re serious about being safe.

Credit: www.nerdwallet.com

Required Car Insurance in Massachusetts

In Massachusetts, you need to have some types of insurance:

- Bodily Injury: This pays for injuries to people.

- Property Damage: It pays for damages to cars and things.

- Personal Injury Protection: This helps pay your medical bills.

- Uninsured Motorist: This is for when the other driver doesn’t have insurance.

Credit: www.texaninsurance.com

How to Choose the Right Car Insurance

Choosing the right insurance is important. Here’s how you can pick a good one:

- Make sure it covers everything the law requires.

- Think about what extras you might want, like roadside assistance.

- Read reviews of the insurance company to see if others like it.

- See how easy it is to file a claim if you have an accident.

- Check if they give good service when you need help.

Remember, the cheapest option isn’t always the best one.

Frequently Asked Questions Of How Much Is Car Insurance In Ma: Your Cost Guide

What Determines Car Insurance Rates In Ma?

Car insurance premiums in Massachusetts are influenced by factors like driving history, vehicle type, coverage levels, and personal demographics such as age and credit score.

Is Car Insurance Mandatory In Massachusetts?

Yes, car insurance is legally required in Massachusetts, following the state’s minimum coverage laws for personal injury protection and property damage.

How Does Age Affect Car Insurance In Ma?

Younger drivers in MA typically pay higher insurance rates due to their lack of driving experience, while older drivers often benefit from lower premiums.

Can Driving History Impact Ma Insurance Costs?

Absolutely. A clean driving record can lead to lower car insurance rates, while accidents and violations may result in increased premiums in Massachusetts.