Are you wondering why your car insurance bill is suddenly higher? Let us explore the possible reasons together!

Introduction to Car Insurance Changes

Everyone with a car has insurance for it. It’s there to protect us.

But sometimes, the price we pay for insurance can go up a lot.

In this article, we’ll look at why this might happen.

A Closer Look at The Price Hike

Did your car insurance go up by $100? Here’s why that could happen:

- New Traffic Tickets or Accidents

- Changes to Your Credit Score

- State Laws or Changes in the Insurance Company

- An Increase in Your Area’s Risk Factor

- Car’s Age and Type Can Play a Role

1. New Traffic Tickets or Accidents

One common reason for a price increase is your driving record.

If you got a ticket or were in an accident, your insurance might go up.

2. Changes to Your Credit Score

Did you know your credit score can affect your insurance?

If it gets lower, your insurance cost might rise.

3. State Laws or Insurance Company Changes

Sometimes, laws can change how much insurance costs. Your car insurance might have gone up for such a reason.

Insurance companies might also change their prices.

4. An Increase in Your Area’s Risk Factor

If more accidents or thefts happen where you live, your insurance price might go up.

5. Car’s Age and Type Can Play a Role

The kind of car you own affects your insurance cost.

Older cars or sports cars can have higher insurance costs.

Credit: www.bloomberg.com

Understanding Your Policy

Insurance is full of big, complicated words. But it’s important to understand what they all mean.

Understanding your insurance policy helps you know why costs can change.

It’s like a special deal between you and the insurance company.

How to Manage Rising Insurance Costs

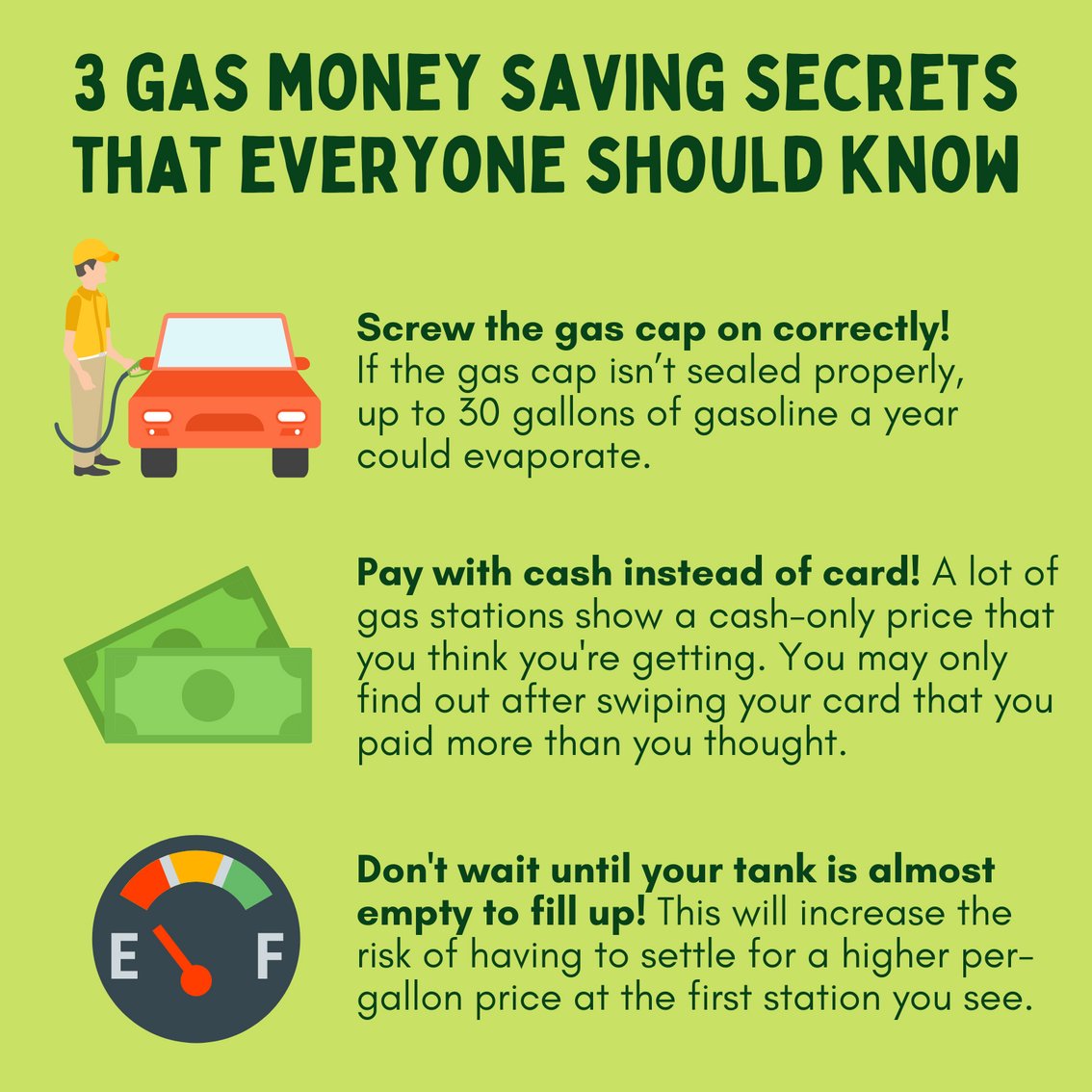

Don’t worry, there are ways to keep your insurance costs down:

- Shop around for better deals.

- Ask for discounts.

- Drive safely to keep a clean record.

- Consider a higher deductible.

- Keep your credit score healthy.

Credit: twitter.com

Table: Ways to Save on Car Insurance

| Tip | How It Helps |

|---|---|

| Compare Quotes | Finds you better prices. |

| Discounts | Lowers your cost if you qualify. |

| Safe Driving | Keeps records clean, costs low. |

| Higher Deductible | Means lower monthly payments. |

| Good Credit | Can give you better rates. |

Important Notes to Remember

Here are some final tips to keep in mind:

- Always read your insurance policy carefully.

- Ask questions if something is not clear.

- Check for any mistakes in your insurance records.

- Stay informed about state laws that can affect insurance costs.

- Know your insurance coverage limits.

Frequently Asked Questions For Why Did My Car Insurance Go Up $100? Uncover The Reasons!

Why Did My Car Insurance Increase Suddenly?

Your car insurance may have increased due to factors such as traffic violations, claims history, or changes in credit score.

Can Moving Affect My Car Insurance Rates?

Absolutely, relocating, especially to an urban area with higher risk of theft or accidents, can raise insurance rates.

Do Traffic Tickets Impact Insurance Costs?

Yes, traffic tickets, especially for moving violations, typically result in higher car insurance premiums.

How Do Age And Gender Influence Car Insurance?

Younger male drivers generally face higher insurance rates because they’re statistically more prone to accidents.